Financial services institutions have long been a top target for cyber threats. Access to a large amount of sensitive and confidential information makes the financial sector a target-rich environment for cyberattacks. In addition to mitigating cybersecurity threats, financial firms must also prioritize maintaining and strengthening compliance. These balance of these two priorities presents a unique set of challenges for companies in financial services.

With the inherent diversity of the financial services sector and the shifting cybersecurity and compliance landscape, identifying a one-size-fits-all set of vulnerabilities for all financial services institutions is impossible. However, there are common vulnerabilities to be aware of.

-

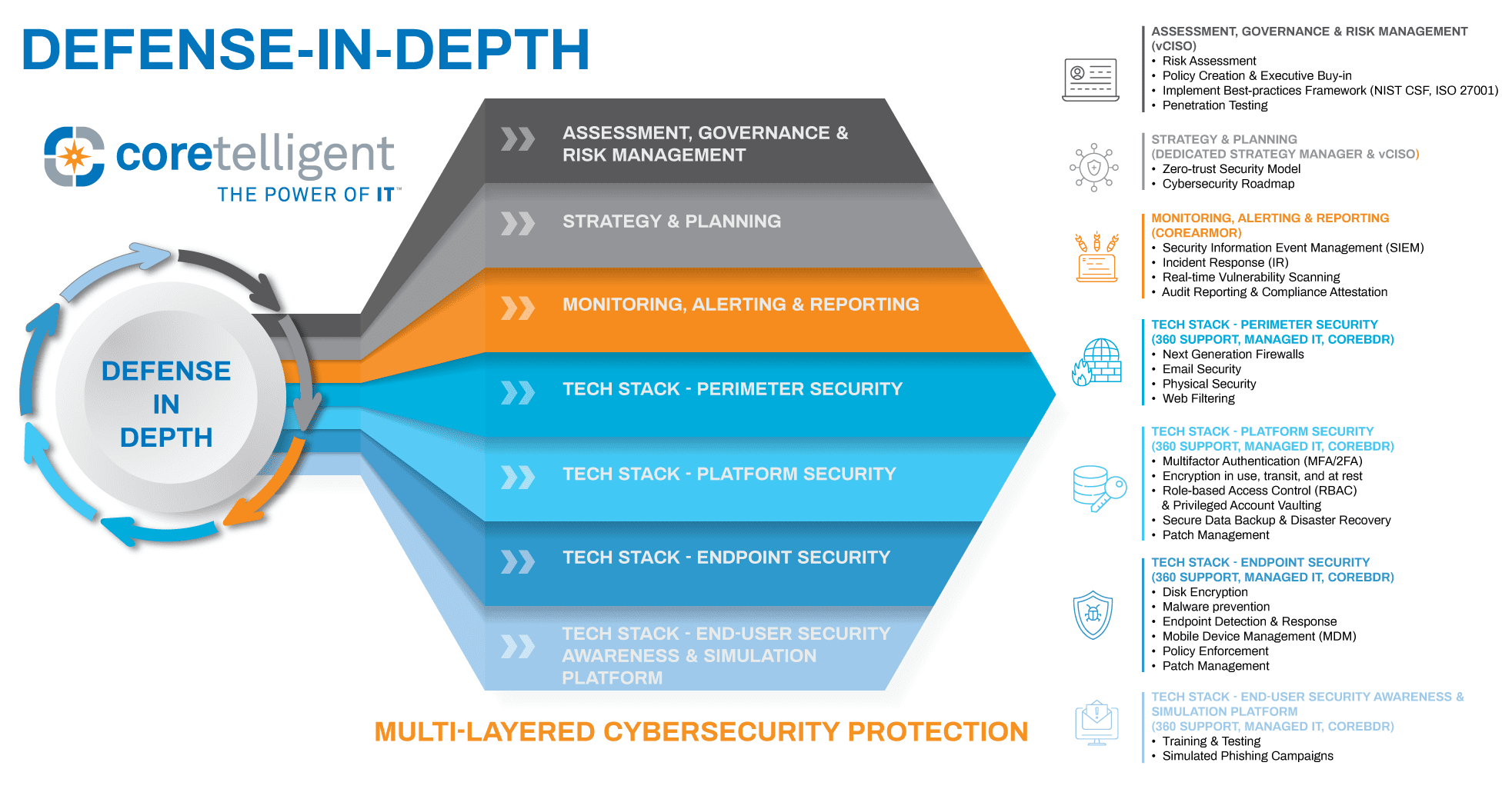

Reactively Evaluating Current Cybersecurity Posture:

Institutions cannot address cybersecurity and compliance vulnerabilities of which they are unaware. Moreover, leaving these vulnerabilities unaddressed can have costly consequences. If unaddressed until an incident occurs, institutions have no choice but to utilize a reactive approach that can leave the business facing outages and shaken customer confidence. Instead, financial service firms should consider taking a proactive approach. By utilizing Coretelligent’s Cybersecurity Evaluation Checklist designed for financial services as a jumping-off point, financial service firms can do an initial assessment of existing vulnerabilities to discuss with a managed service provider (MSP).

-

Ransomware Attacks:

As the world continues to become more digitally integrated, opportunities for ransomware attacks grow exponentially. In a ransomware attack, attackers use malware to gain access to your organization’s systems or data and hold that data until a ransom is paid by the organization. The results of these attacks are devastating. In addition to the price of the ransom, there are legal fees and other costs associated with damage control, as well as potential loss of data.

-

Access Vulnerability:

Flaws in various levels of access to information can leave sensitive data exposed and vulnerable for attackers. Cybersecurity integration is key across all divisions and at all levels of access in an organization. Cybercriminals will seek to exploit any weaknesses identified at any level, regardless of the internal structure of the business.

-

Managing Compliance:

The evolution of information technology has increased the compliance burden on the financial services industry. Financial service organizations are amongst the most regulated business segments in the U.S. However, simply maintaining compliance may no longer be enough. Instead, actively managing compliance risk and strengthening compliance overall is key in earning customer confidence and avoiding costly penalties.

-

Business Continuity:

What comes next if the worst happens and a cyberattack hits your company? Is your data backed up safely? How quickly would you be able to restore access to users? A proactive and dynamic backup and disaster recovery solution is critical for preventing business interruption and loss of essential data, which could trigger a compliance violation. Off-the-shelf, onsite backup solutions often do not provide the level of performance required to meet the needs of financial and investment organizations. It is vital to establish a solution before an outage to ensure timely recovery and minimize interruption time for clients.

Addressing security and compliance vulnerabilities may seem challenging, but Coretelligent can help. Working with Coretelligent means working with an IT partner who understands both the security and compliance needs of the financial services sector. Contact us today at 855-841-5888 or fill out our online form.

Indicates significant changes to regulations for broker-dealers, investment companies, RIA, and other market agents.

Indicates significant changes to regulations for broker-dealers, investment companies, RIA, and other market agents.

Yesterday, the Cybersecurity Infrastructure & Security Agency (CISA), the federal agency charged with protecting the nation’s cyber infrastructure, released a notice from the

Yesterday, the Cybersecurity Infrastructure & Security Agency (CISA), the federal agency charged with protecting the nation’s cyber infrastructure, released a notice from the

Disasters and cyber-attacks happen, but data loss does not have to be inevitable. Data loss can be

Disasters and cyber-attacks happen, but data loss does not have to be inevitable. Data loss can be

In late August of 2021, the

In late August of 2021, the